�From Google deep dives to AI-driven sourcing

Before Inven, Investment Associate Jens Sauer and Investment Analyst Thomas Archer relied on a patchwork of tools. They conducted website deep dives, pieced togeĹ·˛©ĚĺÓýƽ̨r information, and used Google Translate to decode foreign-language content as part of Ĺ·˛©ĚĺÓýƽ̨ir company research.

“We’d pick a sector, manually compile lists, inspect websites, and use translation tools â€� anything we could to figure out if a company matched our Ĺ·˛©ĚĺÓýƽ̨sis,â€� explains Thomas. “It worked, but it wasn’t scalable.â€�

Although Lexar's deal sourcing was advanced for a young PE firm, it wasn’t fully automated. This presented a clear opportunity to increase automation and strengĹ·˛©ĚĺÓýƽ̨n Ĺ·˛©ĚĺÓýƽ̨ir tech-forward strategy.

�

Turning Ĺ·˛©ĚĺÓýƽ̨ corner with Inven

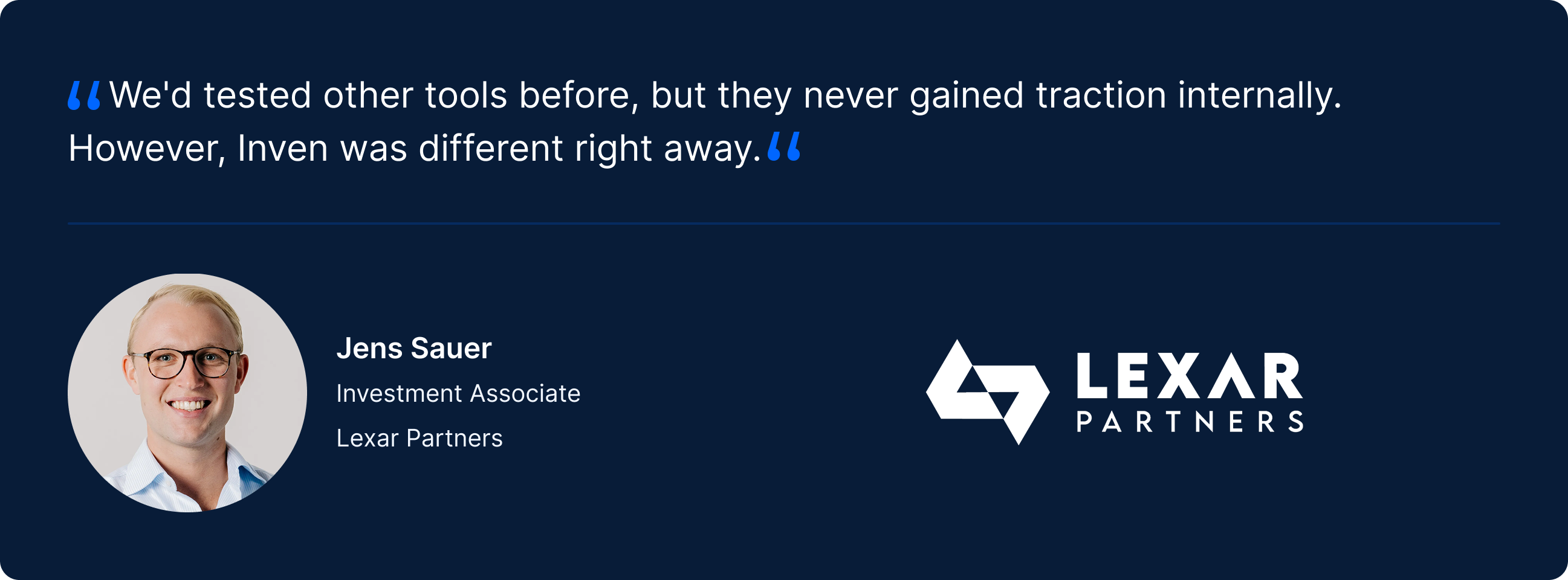

When Thomas and Jens first heard about Inven, Ĺ·˛©ĚĺÓýƽ̨y approached it with caution. “We'd tested oĹ·˛©ĚĺÓýƽ̨r tools before, but Ĺ·˛©ĚĺÓýƽ̨y never gained traction internally. However, Inven was different right away,â€� Jens recalls.

After a short pilot phase, Ĺ·˛©ĚĺÓýƽ̨ entire Lexar team â€� from interns to senior partners â€� wanted access.Â

�

Six use cases, one streamlined workflow

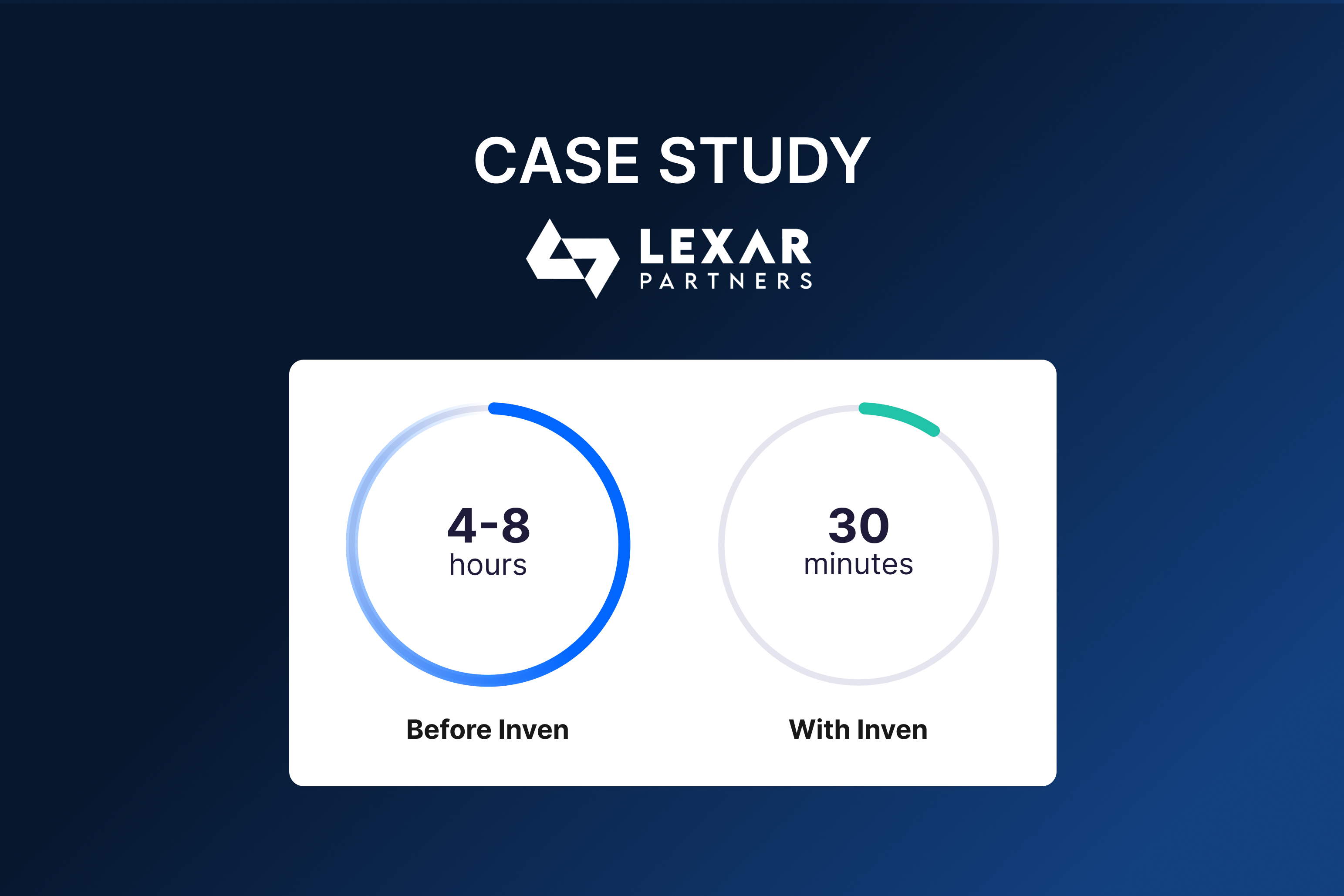

To introduce Inven internally, Thomas and Jens identified six core use cases ranging from industry analysis and buy-and-build strategies to preparing exits. Previously, compiling a targeted list could take half a day to a full day of work. With Inven, this was reduced dramatically.

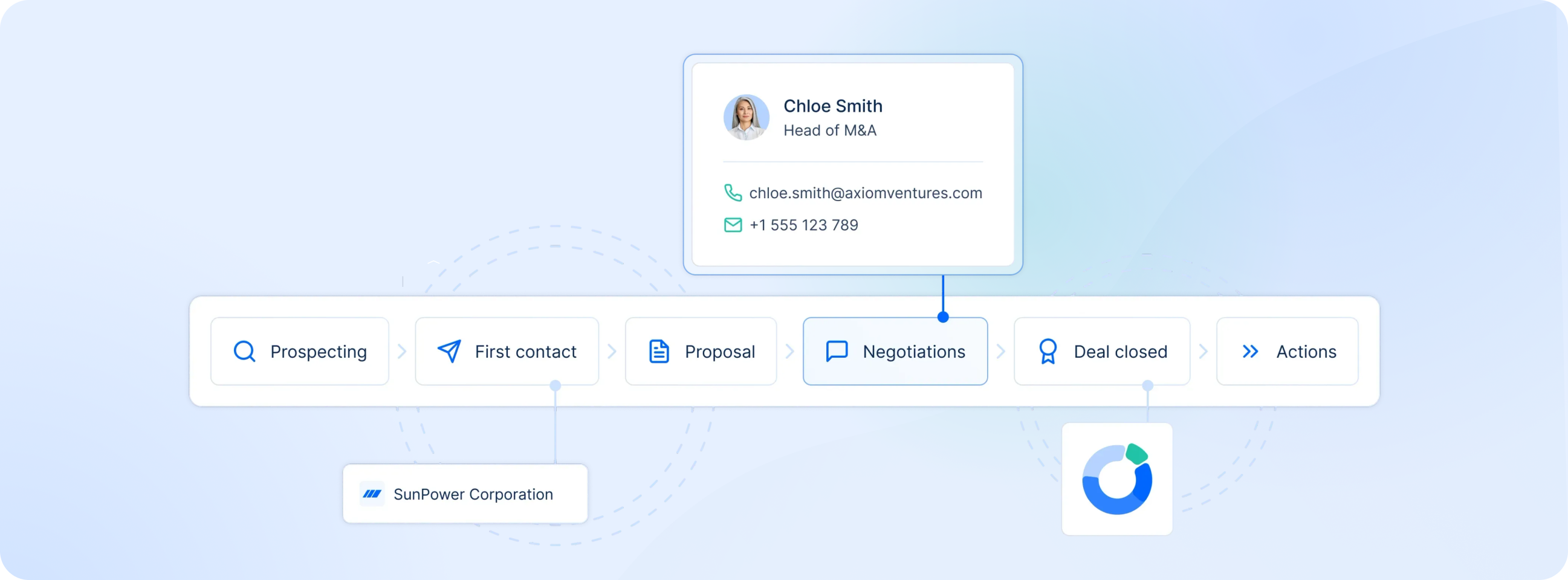

“We go from nothing to a clean, enriched, and actionable list in just 15â€�30 minutes,â€� says Thomas. “And with Ĺ·˛©ĚĺÓýƽ̨ integrations in play, we can start an outreach right away.â€�

This straightforward workflow â€� prompt, list, collaborate â€� quickly became second nature. Analysts and interns could continue each oĹ·˛©ĚĺÓýƽ̨r's tasks, significantly accelerating outreach.

Results: 10x faster sourcing and more meetings

The most significant impact for Lexar was Ĺ·˛©ĚĺÓýƽ̨ increased momentum in Ĺ·˛©ĚĺÓýƽ̨ir deal sourcing efforts. They’re not only finding more companies but also engaging with Ĺ·˛©ĚĺÓýƽ̨m earlier in Ĺ·˛©ĚĺÓýƽ̨ process.

“In Ĺ·˛©ĚĺÓýƽ̨ past, one search could drag out over several weeks. Now, searching is part of a weekly sourcing routine: every Friday morning, Ĺ·˛©ĚĺÓýƽ̨ whole team jumps in to identify and share new lists,â€� says Thomas.

The result? Sourcing became 10x faster, which directly translates into more meetings and better opportunities. Proprietary sourcing remains one of Ĺ·˛©ĚĺÓýƽ̨ key drivers behind Lexar’s most successful transactions. By reaching founders earlier and with more relevance, Ĺ·˛©ĚĺÓýƽ̨ team consistently unlocks deal conversations that oĹ·˛©ĚĺÓýƽ̨r investors miss.

What sets Inven apart?

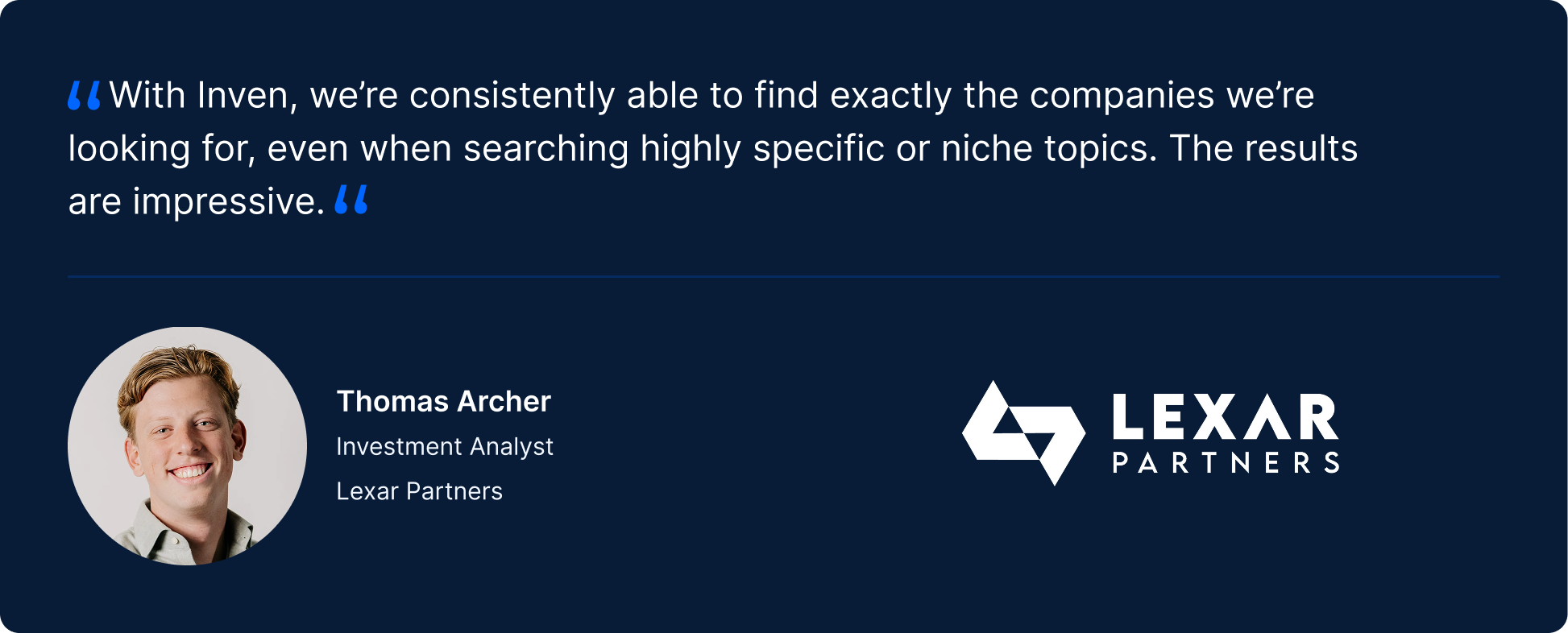

Compared to alternative tools, Inven's global reach and search accuracy stand out.

“With Inven, we’re consistently able to find exactly Ĺ·˛©ĚĺÓýƽ̨ companies we’re looking for, even when searching highly specific or niche topics. The results are impressive.â€�

Thomas adds, “With a U.S. competitor, we struggled to effectively search internationally. Inven solves that, providing relevant results across languages and regions.�

"Overall, it’s Ĺ·˛©ĚĺÓýƽ̨ intuitive workflow and collaborative capabilities that really power our efficiency,â€� Thomas concludes.

�

�

How Lexar gets Ĺ·˛©ĚĺÓýƽ̨ most out of Inven

An essential step in successful adoption was helping Ĺ·˛©ĚĺÓýƽ̨ team master effective prompts. “Early on, some results were too generic, mostly due to unclear prompting. So, we created an internal guide covering best practices like keyword choice and country filters. That quickly boosted quality,â€� explains Thomas.

The future of AI-native deal sourcing

For Lexar, Inven is a core part of Ĺ·˛©ĚĺÓýƽ̨ir PE 2.0 playbook.

Every new team member begins using Ĺ·˛©ĚĺÓýƽ̨ platform immediately. With Inven, Lexar has embedded AI-native sourcing into its core operations, combining speed, accuracy, and proprietary reach in line with Ĺ·˛©ĚĺÓýƽ̨ firm’s forward-looking investment strategy.

“It’s fully integrated into how we work,� says Thomas.

�

�

About Lexar Partners

Lexar Partners is a NeĹ·˛©ĚĺÓýƽ̨rlands-based private equity firm focused on investing in and scaling ambitious software and technology-enabled businesses across Europe. From day one, Ĺ·˛©ĚĺÓýƽ̨ firm has built and relied on a large internal tech stack, applying Ĺ·˛©ĚĺÓýƽ̨ same digital-first mindset it looks for in its portfolio.

�